Fifty Years Ago: A Landmark Day in Economic History

With a single dramatic stroke, President Richard Nixon ended one monetary era and began another, in which we are still living.

Some dates live in the American collective memory: July 4, 1776, when representatives of the thirteen British colonies in North America declared their independence from the mother country; December 7, 1941—“a day that will live in infamy,” as Franklin Roosevelt called it—when Japanese forces attacked Pearl Harbor in Hawaii; and September 11, 2001, when the United States suffered the worst terrorist attacks in its history. August 15, 1971—fifty years ago this coming Sunday—does not have the same status, yet what took place on that day was, in its own way, as consequential for the United States and the world as were the events on those other, epochal dates.

On that summer Sunday, following three days of meetings with his senior economic officials at the presidential retreat Camp David in the Catoctin Mountains in Maryland, President Richard Nixon brought crashing down the international monetary arrangements that the United States, Great Britain, and other countries had devised at a conference in Bretton Woods, New Hampshire, in 1944. The Western world had lived, and prospered, with these arrangements since the end of World War II. What Nixon did affected all cross-border trade and investment everywhere—and continues to do so.

The events surrounding July 4, 1776, December 7, 1941, and September 11, 2001, have long since been microscopically reconstructed by journalists and historians. Now August 15, 1971, has received a definitive accounting in Three Days at Camp David: How a Secret Meeting in 1971 Transformed the Global Economy by Jeffrey E. Garten. The author’s background in finance, government service, and academia—he is the dean emeritus of the Yale School of Management—admirably equips him for this task. The book he has written offers a clear presentation of the often arcane and obscure monetary issues involved, vivid portraits of the government officials who took part in the deliberations leading up to the Nixon announcement, and a useful and in some ways surprising assessment of the August 15 initiatives from the perspective of fifty years.

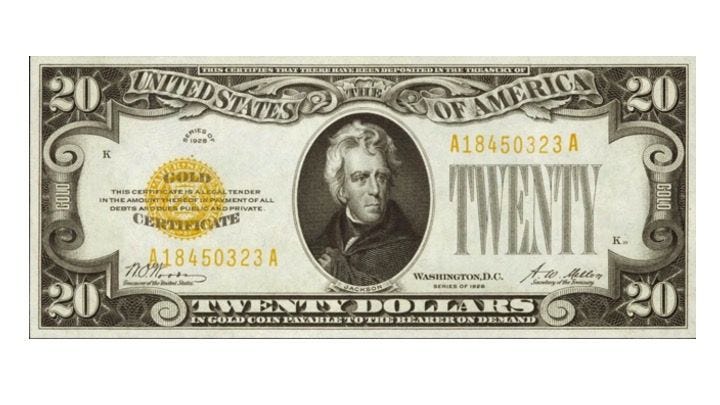

The Bretton Woods system that ended that day had succeeded the pre-war gold standard, which had collapsed during the Great Depression of the 1930s. That system was designed to provide the fixed exchange rates between and among the currencies of different countries that international trade and investment were thought to require, but with greater leeway for national economic policies than the gold standard had permitted. Instead of all currencies being tied to gold, they were linked to the American dollar, which was in turn tied to gold. Dollars could be redeemed for gold from the United States by other governments at the rate of $35 per ounce.

By August 15, 1971, two contradictions had made the Bretton Woods system unstable and susceptible to crisis. One was the contradiction between the dollar’s two different roles: it provided global liquidity, which required an expansion of the world’s supply of the American currency to underpin global economic growth, but it also served as the primary reserve currency, which required limiting its supply so that other countries could always exchange as many dollars for gold as they wished. By 1971 there were many more dollars in circulation worldwide than the United States could redeem at $35 per ounce. The other contradiction was between the world’s interest in policies such as high interest rates that would limit the outflow of dollars from the United States and the American national interest in policies—above all low interest rates—that would promote economic growth at home.

The United States faced two other, related economic problems as well. First, the dollar had become overvalued in relation to other currencies, especially those of West Germany and Japan, which had expanded the imports to and diminished the exports from the United States, thereby costing American jobs. Increased imports put workers in import-competing industries in the United States out of work. Decreased exports meant that exporting industries employed fewer Americans. Second, for a variety of reasons inflation had become a serious problem in the United States.

Facing an election the following year, and with the perceived danger that other countries would make demands for gold that the American government would not be able to meet, which risked both political humiliation and a serious worldwide economic crisis, Nixon unilaterally terminated the Bretton Woods system. He did so by declaring that the United States would no longer exchange dollars for gold. In addition, he announced a freeze on wages and prices in the United States in order to stem the tide of the inflation that closing the gold window would only exacerbate. Finally, he imposed a 10 percent tax on imports, which he intended to use as leverage to compel other countries to increase the value of their currencies vis-à-vis the dollar. All in all, the Nixon measures have a claim to being the most sweeping and consequential single economic package in American history.

Of the officials whom Garten portrays, two stand out for their importance: Secretary of the Treasury John Connally and President Nixon himself. A largely forgotten figure today, Connally was a formidable political force fifty years ago. A Texan with a long association with Lyndon Johnson, he served as Secretary of the Navy in the early 1960s and then won the governorship of his home state. He was in the car with President John F. Kennedy on November 22, 1963, in Dallas when the President was assassinated, and Connally himself was wounded. Nixon admired Connally, appointed him to the Treasury post in 1971, and at one point hoped that the Texan would succeed him in the presidency.

On monetary matters Connally was an economic nationalist. He took the view that Germany, Japan, and other countries were exploiting the United States in economic terms and that America should therefore abandon the rules that made this possible. He encouraged Nixon not only to close the gold window but to do so as part of a single package rather than as one of a series of more modest measures. Because of his forceful personality, because he was attuned to Nixon’s preference for surprise and blockbuster initiatives (the President had recently stunned the world by revealing that he would visit China, a country from which the United States had been estranged for two decades), and because he well understood, as a fellow politician, the President’s political calculations, Connally’s counsel prevailed.

As for Nixon, the initiatives he launched displayed one of the distinguishing features of his presidential political style: a penchant for reversing himself. Just as he carried out conciliatory policies toward the Soviet Union and the People’s Republic of China after beginning his political career as a fierce anti-communist, so he imposed extensive controls on the American economy after a long history of opposing them and levied a tariff on imports after a political lifetime as a free trader.

His strongest motive for the August 15 measures was undoubtedly concern about his own prospects for re-election in 1972. He feared a dollar crisis that would diminish those prospects and acted to preempt it; and he was determined to pursue policies that, while weakening the dollar abroad, lifted employment at home, which he regarded as the key to his electoral success. He is therefore vulnerable to the charge that he placed his personal political interests over the integrity and well-being of the international economy. Yet all Presidents make policy with an eye on their political standing, and Nixon was more sensitive to the potential impact of the August 15 initiatives on the global economy and America’s system of alliances than Connally was, and perhaps than other politicians in his position would have been.

In closing the gold window, the Nixon Administration did not intend to do away with the Bretton Woods system entirely but rather to reform it by changing the dollar’s exchange rate with other currencies to make American exports more competitive. The President and his colleagues did not envision eliminating fixed exchange rates altogether, but that is what in fact occurred. For fifty years those rates have floated, changing their relative values according to changing economic conditions and government policies. The world has not replaced the Bretton Woods rules with new ones, producing, in monetary terms, what has been called a “non-system.”

For this and other reasons the August 15 measures have come in for criticism, and Garten agrees with some of it. On balance, though, his retrospective assessment of what Nixon and his economic officials wrought is positive: the Bretton Woods system had reached the end of its useful life; ending it with a single blow was probably preferable to trying to reform it with a series of lesser measures; and floating exchange rates, although not without their problems, have on the whole served the United States and the world better than fixed ones would have, if they could have been reinstituted. Fifty years ago, critics of the decision to close the gold window feared that, lacking a monetary anchor, inflation would explode everywhere. Prices did rise sharply in the United States and elsewhere over the next decade but, as Garten persuasively argues, this was caused mainly by other developments, above all the two oil shocks of the 1970s.

The abandonment of the Bretton Woods system, as the author notes, fits into a larger pattern of American foreign policy in the Nixon era. That administration took a series of steps designed to lighten the international burden the United States had carried since the end of World War II, which had become heavier than the American public was willing to bear, while retaining the country’s basic postwar commitments to its European and Asian allies. The measures of August 15 had the same general goal as the policies of détente and arms control with the Soviet Union and the political rapprochement with mainland China. Together this suite of policies executed a largely successful mid-course correction in American foreign policy in response to the Vietnam War, which made Nixon’s the most consequential foreign policy presidency between the beginning and the end of the Cold War.

The monetary shift differs from the other policies in this category in one important way, however. With the Soviet Union long gone and China more an adversary than a friend, the others are now of largely historical interest. The consequences of August 15, 1971, by contrast, remain part of the international economy today. Fifty years later, the world still lives with the monetary conditions that the events of that day created.

Michael Mandelbaum is the Christian A. Herter Professor Emeritus of American Foreign Policy at the Johns Hopkins School of Advanced International Studies, a member of the editorial board of American Purpose, and author of The Rise and Fall of Peace on Earth (2019).