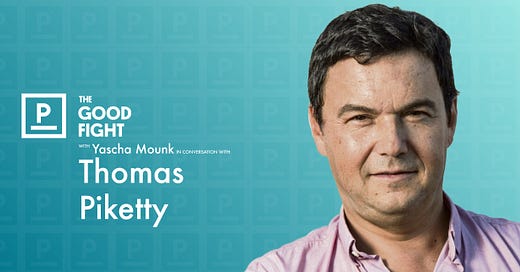

Thomas Piketty is one of the foremost economists in the world, renowned for his work on wealth concentration and inequality. The author of the bestselling Capital in the Twenty-First Century, his latest book, A Brief History of Equality, focuses on the ways in which the world has become more equal over the course of the last centuries.

In this week’s conversation, Yascha Mounk and Thomas Piketty discuss why inequality has increased within rich countries over the course of the last few decades, how this fits into the broader history of equality, and what politicians need to do to afford greater affluence for all.

The transcript has been condensed and lightly edited for clarity.

Yascha Mounk: I'm interested in the evolution of your thinking over the course of the last decade from Capital in the Twenty-First Century to your new book A Brief History of Equality.

Let's start at the beginning: what is the core argument of Capital, and what is the meaning of that famous slogan “r>g”?

Thomas Piketty: Oh, you're bringing me back ten years before? Let me say, generally speaking, that I've been working on the history of the distribution of income and wealth for twenty years now. And I'm trying to make progress in this direction. My new book, my brief history of equality, is not only briefer than the first two books, but I think it's probably also clearer about the big message, which is this long-run movement toward equality starting at the end of the 18th century, with the French Revolution and the US revolution, and this movement continuing throughout the 19th and 20th centuries and until today. In this very broad perspective, r>g is still important. It's always been important. And one way to realize what it means and the role it plays is if you look at the evolution of wealth holders in recent decades, or even during the pandemic. If you look at global billionaires ten years ago, the richest used to own 30 or 40 or $50 billion, and today, they have 200. So, if you look at the evolution of the rate at which top wealth holders increase their wealth, it is of the order of 7 or 8% per year, which is obviously a lot bigger than the growth rate of world GDP. The growth rate of real GDP could be 2 or 3% per year—that's partly due to population growth—or actually, you could look at average income: on average it’s 1 or 2% per year.

R>g first means that you have a rate of return on wealth, and especially in the top wealth portfolios, which tends to be bigger than the growth rate. Now, that doesn't mean that the rate of return for small savings is bigger than the growth. The interest rate right now is 0%—actually it’s negative, if you look at the real interest rate and take away inflation. So for people who have little savings, (r) is certainly not greater than (g). To take another example, I collected data on large university endowments, which is interesting, because in the US, you have 800 universities with capital endowments, and you have pretty good data about what they do with the endowment and the rate of returns, which is not the case for billionaires. The kind of information we have in Forbes magazine is of not so high quality. With university capital endowments we have really good data. And so, what I have shown in Capital is that if you take a long period of time, 1980 to 2010, the very highest capital endowments will get a net return—net of inflation, net of all administrative expenses, operating expenses—of 7, 8, or 9% percent per year; the middle endowments, 5 or 6%; the very small endowments, 2 or 3%. If this university is doing useful things with money, that's okay. Well, maybe this creates huge inequality among US universities, and the bottom half or two-thirds of US universities don't have as many resources as I think they should have. And sometimes very top places have more money than they are able to spend in a useful manner. But in any case, if you apply this kind of mechanism to private individuals, and to the distribution of wealth in general, you can see how this mechanism can contribute to unsustainable levels of wealth concentration, and it's more than just the question of money.

The distribution of wealth is first and foremost about the distribution of power; to make decisions about your life, to invest, to create a firm, to protect your family. I’m not asking for complete equality, but you know, you have such a huge concentration of wealth at the top, and the middle class is diminishing their wealth share, and the bottom 50% basically never own anything, and don't have much security or much economic opportunity to invest or create wealth. I think it's not only unfair, but pretty inefficient for society in general. Now, the good news is that there are many ways around this, through policies and through institutions, fiscal policies, and the transformation of the legal system, giving more power to workers, reinventing the very notion of property and property relations so that different people can participate in decision making. This is not only a dream; it’s what we've seen over the past two centuries. This is the optimistic perspective on the history of equality, which I really want to communicate.

Mounk: I want you to help me, as a non-economist, think through the main criticism of Capital. So I'm going to do a layman's best attempt at summarizing that criticism, which is that when you look, for example, at the richest people in the world today, they are not people who are inheritors, who have invested their money—they are actually people who come from upper middle class families and have made their fortunes through entrepreneurial activities: Elon Musk, Jeff Bezos, Bill Gates, Warren Buffett, Larry Page, Sergey Brin, Larry Ellison. And in fact, supposedly, this shows that in the last 50 or so years (r) has not been bigger than (g). And in a related line of criticism, the concentration of wealth doesn't come from the very richest people—the billionaires that we love to hate—but from private property, especially in residential property, held among the upper middle class. So that actually to the extent to which wealth has outpaced the increase in incomes, it is because of, frankly, the lawyers and doctors and academics who probably listen to this podcast who have nice apartments in New York City, San Francisco, and Paris. Why do you think that those criticisms are wrong?

Piketty: Let me start with the mobility argument, and then I will get to the role of real estate. Those issues are really important and interesting. Although I disagree very much with both of those statements, let me start with mobility. Of course, you always have people at the top who come from nowhere. I mean, you can also mention Russian oligarchs, because their parents were not rich: there was not no private property in the Soviet Union. By definition, these are self-made men now.

We in the West like to explain that the Californian and European beginners have nothing to do with Russians, but if you look at the dynamics of wealth, it's always about making good deals: buying firms at a time when the price is low, selling them when they are very high; making huge capital gains, even even if you yourself don't make a big invention. Bill Gates did not invent a computer. Elon Musk did not invent Twitter or the electric car engine. You have tens and hundreds of thousands of engineers and researchers who have contributed to this invention, because wealth creation is always a very collective process. We've been accumulating knowledge since the beginning of mankind, and many people are involved in these discoveries. We don't put their name at the bottom of the academic article all the time. Private property is a social construction that we invent as societies, and which is actually a useful invention to the extent that we put limits on how much wealth concentrates. But let me start by saying: all wealth creation in history is collective in nature and we should stop thinking about individual geniuses who have created everything. This kind of monarchical view of the economy is completely outdated and has nothing to do with the reality in which we live today.

Mounk: The nature of the objection, as I understand it, is not that Elon Musk deserves all of his money. It's just that it seems to be a counterexample to the idea that the driving force in our economy for the last decades has been returns on capital.

Piketty: It depends really on what you mean by “returns on capital.” If you're making huge capital gains, that’s a form of return on capital. You have enormous returns on capital, which are very concentrated for a small group of capital owners, whether it's a Russian oligarch who bought shares in a Russian sector at a very low price, or whether it's Zuckerberg with Facebook, buying the share of one of his associates at a very low price, and then the price skyrocketing. If you look at all wealth, big fortunes, it's always been like that. I like to compare wealth concentration today with wealth concentration at the end of the 19th century, before World War One. The idea that innovation and mobility is only a characteristic of today and was not the case in the past is completely crazy. 1900-1910 is the time where we invented the automobile and electricity, which are at least as important as Facebook and Twitter today. But this mobility and this innovation cannot justify any level of wealth concentration—and when you look back at this period, and you compare with the following period, my conclusion is that the level of wealth concentration that we had then, even though it was largely self-made, and largely based on mobility, was very much excessive, in many different senses. It contributed a lot to the political instability of Western societies, and in the end to the rise of World War I and II. And also, from a purely economic perspective, it was not necessary. This extreme level of wealth concentration was drastically reduced through world destruction, but also through progressive taxation and change in institutions. In the end, the much lower level of wealth concentration that we had after World War II actually increased mobility, because you had some people from the middle class moving up, and you had less extreme concentration of power.

It's always difficult to decompose what’s due to luck, or what’s making a good deal against someone else, or what’s a useful contribution. But if we look from a collective perspective at the level of wealth concentration, this is what matters. Now, going back to real estate and the middle class, you said that the increase in wealth inequality is not due to the millionaires at the top but rather upper middle class people who own real estate. That's not quite right. You're certainly right that we cannot just look at billionaires—we need to look at millionaires and multimillionaires. I stressed a lot that if we want redistribution of wealth, we need to target people well above 1 million or 5 million euros. There are lots of people who have 10, 20, 50 million, and in the end, there's a lot of money over there, and you cannot just look only at billionaires. Regarding real estate, however, you are wrong in the sense that, if you look at the share of real estate at different levels of the wealth distribution, the basic fact is that at the very bottom people don't have real estate, just very small bank accounts. In the middle of the distribution, real estate is very important. Now, as you move into the top 10% of the distribution, and even more so in the top 1% or top 0.1, the share of real estate goes back down toward 0%. So in fact, if you look over all the orders of magnitudes, it's important to bear in mind that the bottom 50% always own close to zero, always less than 5% of total wealth, 2% in the U.S. In Europe, 4%. In Latin America, 1%. So what matters in the end is what you have in the 40% who are in between the bottom 50 and the top 10—which I call the “patrimonial middle class.” Now, when real estate prices go up, that's going to be good in relative terms for this middle 40% relative to the top 10%. Because the top 10% have much less real estate as a percentage of their total than this middle 40%.

And in spite of that, their wealth share has declined. If you had only the real estate price effect, the wealth share of this middle 40% should have increased—but in fact, it has declined. The increase in the real estate price has mitigated the increase in top wealth concentration. But in spite of this mitigating effect, the key effects driving increasing wealth concentration have nothing to do with real estate. It has to do much more with financial portfolios getting much higher returns. And when you have 1 billion reserves rather than 10 million, you can invest in financial derivatives, private equity, commodity derivatives—a set of sophisticated financial assets which are not accessible even if you own 1 million. This effect doesn't make the cover page of news magazines like Bezos or Zuckerberg do, but it’s very important. Your real estate part of the story is not what's going to explain the increase in the top 10% wealth share, and certainly not the top 5% or top 1% wealth share.

Mounk: That was an interesting answer, because I never quite knew what to make of that objection. I promised that we would talk about the positive message. So you write in the introduction to your new book that at least since the end of the 18th century there has been a historical movement toward equality. The world of the early 2020s, no matter how unjust it may seem, is more egalitarian than that of 1950, or that of 1900, which were themselves in many respects more egalitarian than those of 1850. Just at a descriptive level, talk to us about that progress. Why is it that in 2022, just looking at the state of equality in the world, we should at first glance be heartened relative to our own past?

Piketty: What I'm trying to do in A Brief History of Equality is to escape from the current pessimism and take a broad, historical-comparative perspective. And the broad trend is evolution, a long-run movement toward equality, which is not something that happened naturally, but through huge political mobilization, social struggles, and most importantly through constructive transformation of the legal systems, institutional systems: the electoral, the tax, educational systems, etc. It's not a movement that has been there since Neolithic times; it's grounded in history. In particular, it starts at the end of the 18th century, with the abolition of the privileges of the aristocracy during the French Revolution on the one hand, and the slave revolt in Saint-Domingue in 1791, which is partly due to the French Revolution, but largely due to the slaves themselves (people in Paris didn't want to put an end to slavery initially). So it's really a slave revolt which is the beginning of the end of slave and colonial societies.

On the other hand, you can see that these two movements are still not over, in the sense that we still live in societies where the privileges of money in politics in particular are very important. When we look at what we call democracy, today, we come to realize that maybe it's better than in the 19th century, where only the wealthiest people could vote—but it has nothing to do with a real democracy, where you could expect a very strict limitation of the role of private money in politics, in the media, in think tanks, and far more egalitarian rights to participate to the political process. We had the abolition of slavery, decolonization, the end of apartheid, the end of segregation. But we still have enormous discrimination and racial inequality today, both at the domestic and international levels.

These two evolutions continued during the 19th and 20th centuries, with the rise of progressive taxation, the rise of social security, and the labor movement, which have brought more equal societies today, radically different from what we had one or two centuries ago. The general conclusion is certainly not that we should be happy and satisfied, but to continue this movement to more equality. We talk about capitalism, but in fact, capitalism today is completely different from the system of one century ago. And so when I talk about the future, and I describe a system of participatory socialism and democratic federalism, many people will say, “Oh, that's so different from what we have today.” Yes, but I would say, it's no more different than what we have today is different from 1950, or 1910, which was very patriarchal, colonial capitalism. We have to put the questions that we're trying to solve today into this broad, historical perspective. If we just say that we cannot change anything to the economic or tax systems, then I think we are contributing not only to the pessimism, but also to this rise of xenophobic populism and identity-based politics, because if you tell people there's nothing they can change about inequalities or the economic system, and that governments cannot do anything except control their frontiers and their borders, then, of course, twenty years later the entire political discussion is about border control and identity.

Mounk: What do you say to people who say, “Hang on a second, you told us about how the benefits going to the very, very richest billionaires in many Western countries is growing, and we have all of these policies which are exacerbating inequality. How can you say that there has been a growth in equality?”

Piketty: Inequality today is still enormous, and has even increased in recent decades, but it is not back to the 19th century levels. The two claims are true at the same time, and maybe that's what's difficult for people to realize; it's a complex reality, and there's been some progress toward more equality, but we still live in very unequal societies. If we look at the bottom 50% of the population, they own almost nothing, on net. If we live in completely equal societies, they should own 50%, which, of course, they don’t. Nowadays, they always own less than five: 2% in the US, 4% in Europe. In the 19th century, it was between one and 2% for the bottom 50%. So there's been a little improvement, but it's still close to zero. Now, the top 10%’s share has declined quite significantly. If you look at European societies before World War One, the top 10% would own 80 to 90% of the total—almost everything. Whereas today, they own 50 to 60% of the total, which is still a lot for 10% of the population, of course, but this is a very significant decline. So, who has gained? Well, the middle 40% who are not in the bottom 50% and not in the top 10%. This group used to own very little, 5 to 10% of the total—a bit richer than the bottom 50% by definition, but not so much richer. So in a sense, there was no real middle class at that time. Whereas today they are 20, 30 or 40% of total. Given that they are 40% of the population, this doesn't make them very rich—it means that on average, they typically own around 100,000 to 300,000 euros. So, you're not very rich, but you're far from being completely poor.

Now, the problem is that, in recent decades, starting around 1980/1990, this share has actually declined a little bit, especially in the US where it used to be like in Europe, 30/35% of total wealth for this middle 40% group. And it's going down toward 20 to 25%. It's still better than in the 19th century, when it was 5 or 10%, but it's not going in the right direction. And in Europe, the increasing inequality has been less strong than in the US, but still, the positive trend has stopped. So, to summarize, we've made progress. But we still have enormous inequality of wealth. In particular, the bottom 50% don't own anything.

Mounk: We have this mixed story, right, where we continue to have a lot of inequality, but society is actually a lot more equal than it was. And it's important to you to emphasize that because you want to emphasize the scope of political agency. So tell us about how political agency actually won those improvements. What political events and what laws and institutions have allowed us over the last centuries to make some significant progress towards equality? And then tell us a little bit about what that implies for the kind of future political action you think would be necessary to make sure that the march towards equality continues.

Piketty: One story will be: we just need to wait for growth and market competition to spread the wealth. The problem is that we've had growth for two centuries, and we've not seen much improvement in the share of the bottom 50%. And so if we just wait for that, this may take a very long time. Another interpretation would be: okay, we cannot do better than that: if we try to redistribute wealth to the world's bottom 50%, the sky is going to fall. The economy's going to stop working, because we actually need this level of concentration of wealth for the economy to operate. Now, that could be true, except that the historical evidence shows that, in the past, when we've had this big decline in the share of the top 10%, and a big redistribution towards the middle 40%, the economy did not stop working. In fact, if anything, this increased the growth rate of the economy.

So, why is this so and how did it happen? And what can we learn for the future? Some people stress, and I have contributed to that, the role of the World Wars in the destruction of very top wealth holders. But in the end, this is not the most important part of the story, because if it was just this, we should have returned to the previous level, more or less, afterwards. So, if we had a structural change in the distribution, this is due to a more positive and constructive reason: generally speaking, the rise of the welfare state and free and public and relatively universal education has not only contributed a lot to modern growth and modern productivity growth, but also has made the distribution of income and the distribution of labor income more equal, and this has also given the possibility for the middle class to save and accumulate more wealth. Tax progressivity—the tax system became more progressive during the 20th century. Asking more tax from people in the top 10% or 20% contributed to reducing taxation for the middle classes, as compared to what you would have had in a system with a regressive tax system, like the one we had in the 19 century. So all these positive factors have contributed to reducing inequality in the long run. The US economy was by far the most productive in the world in the middle of the 20th century due to the fact that there was this very substantial educational advance in the US at the time. In 1950, 90% of the cohort would go to a school. At the same time it was 20-30% in Germany, France, and Japan, and you need to wait until the 1980 and 90s, to see them catch up in both education and productivity.

In the middle of the 20th century, the US tax system was the most progressive in history. Top rates were at 90%. If you take an average between 1970 and 1980, you have a top tax rate of 82%. This does not prevent growth, productivity, innovation, because income gaps of 1 to 100 or 1 to 200 are just not necessary for growth. I'm not saying you want full equality: maybe you need an income gap of 1 to 5, 1 to 10, or 1 to 20. People can disagree about that, but my reading of historical evidence is that 1 to 5 or 1 to 10 at most is absolutely sufficient. My reading of the evidence—and I've spent a lot of time collecting this data comparing societies—is that huge gaps are just not necessary. In recent decades, you've had this huge increase in billionaire wealth, wealth concentration at the top. This was supposed to boost the economy, to lead to a much faster rise of average income and average wages, in particular. This is the promise that Ronald Reagan made in the 1980s. Thirty years later what we see is that the growth rate of national income per capita in the US has been divided by two: between 1950, 1980 and 1990 and 2020. I think this has contributed to huge disappointment in the US, and also to the fact that the Republican Party has become largely “anti-”: anti-China, anti-Mexican, anti-Muslim, because, in effect, they had to find some explanation as to why the hard work of America did not pay off in terms of income growth.

Mounk: When you look at the Democrats today, you find a party who certainly do have very strong support among African Americans and strong but much less univocal support among nonwhite voter groups like Hispanics, but who also—in their leading exponents and strategists, staff, and media outlets which determine much of their language and program—are very dominated by an upper and upper middle class, highly educated elite.

What are the prospects for the Democratic Party or for left wing parties in Europe to be the motor of this kind of historical change towards equality?

Piketty: I think the problem is that the left has given up on ambitious redistributive programs, and indeed has been sort of taken over to a large extent by your university graduate agenda. But I think this is due to a more general ideological transformation that happened during the 1980s and 1990s. The fall of communism and the Soviet Union was very good news for people living in the communist bloc, but this has had all sorts of consequences, one of which is the rise of nationalism in Russia, as we see today. And in the West, this contributed, during the 1990s and early 2000, to the rise of a sort of unlimited faith in the self-regulative power of the market; that market competition and globalization are going to solve every problem, and that we can stop thinking about redistribution or regulation. This has started to change, I think, after the 2008 financial crisis. People have realized the limits of deregulation and market competition. And I think the pandemic has already contributed to the end of neoliberalism. The big question today is, “Is this going to be replaced by neo-nationalism in the U.S., Russia, Europe, India, and Brazil? Or are we going to have the beginning of a new agenda for equality and redistribution—I talk about “participatory socialism.” Some people don't want to use the word socialism: okay, use another word, if you will. But in any case, we need to rebuild an egalitarian, universalist platform. If the left does not go in this direction, they will never be able to regain support from the working class. The good news regarding most of the working class voters is that it's not that they are convinced by the xenophobic right. Most of the working class voters actually stay at home. They just stopped voting. This is what it will take, if you want to bring back to the voting booths some of these voters. Take the billionaire tax and wealth taxation—this is very popular in the U.S., not only among Democratic voters, but also among working class Republican voters. Now, if the Democratic elite keeps opposing this evolution, that's not going to help, because this contributes to portray the left as a sort of elite left. It will take a major transformation of the economic platform in order to achieve this.

Mounk: I know that you're not an American citizen, and you're not a campaign strategist. But let's imagine that Ron Klain, the White House Chief of Staff, rings you up tomorrow and says, “we're struggling in the polls, and there's a real chance that Donald Trump comes back in 2024, and will be a major threat to our democracy. Tell us how we can change in such a way that we will actually help to combat some of these problems, that we will actually make a real move towards equality, and that we mobilize all of those people who are staying home and appeal to them.”

What changes do you think they would need to make, culturally, to make sure that the Democratic Party ceases to be seen as the party of educated elites? And what changes do they need to make in the economic program to appeal to some of the working class voters who are either staying at home today or tempted to vote for Republicans?

Piketty: This is a question about the U.S., right? Because, let me make clear that I'm not particularly hopeful about the U.S. The political system is so corrupted by money and private finance. This can change, but I'm more hopeful about Europe or other parts of the world.

I have proposed to have a minimum inheritance for all: everybody at age 25 receiving 120,000 euros or $150,000, which I think will create a much more dynamic economy. The many poor people in the US, if you look at the bottom 50, 60 or even 70%, don't believe that the economy is fair. They don't believe that people at the top own everything because they are so productive, and that the people at the bottom are just lazy and unproductive. You have people working incredibly hard in the gig economy, in traditional blue collar jobs, in the service sector, in shops, and in all sorts of health sector jobs with terrible working conditions. If you had a platform to redistribute income and wealth in a very ambitious manner in the direction of this group—I think this is simply the only way to try to bring back voters to the voting booth.

If Western countries are not able to promote a model of economic development that's based on more equality within the West, but also at the international level, I think there's a very big risk that somehow the winner of the competition will be the autocratic development model. The stakes are enormous, and we have to give up on the completely wrong ideological claims leading to more concentration of power and wealth in a few hands. I can understand why many people are afraid of democratic deliberation about the proper distribution of wealth, and they say, “Oh, if we start having this democratic deliberation with wealth redistribution, where are we going to stop? That's too complicated. So let's sacralize the winner. Let's not touch it at all.” I can see where it comes from. But at the end of the day, this kind of nihilistic democracy is what's going to give the floor to autocracy. And it’s not based on a proper assessment of history, because if you look at the lessons from the 20th century, very progressive taxation was a huge success, with huge educational and Social Security expansion. These are the new steps that we need to look at today.

Mounk: If fifty or a hundred years from now, somebody writes a follow up to A Brief History of Equality and says, “Things have gone as well as we possibly could have imagined. The march towards equality has continued and perhaps it's even accelerated.” What would that author's description of the present look like? Which is to say, if we succeed in pushing towards more equality, what will our societies be like in fifty or a hundred years?

Piketty: It will be a society with a much more inclusive distribution of power in general. We've talked a lot about wealth in our discussion, but let me stress that what matters most is not so much money in itself, but really the power and opportunities that come with it. When you have no wealth at all, your bargaining power vis-à-vis society in general is very small. If you own zero, or you only have debt, you have to accept everything: any job in any working condition, any wage being proposed, because you need to pay your rent and feed your family. If you own just 200,000 or so euros or dollars—this is very small compared to people with millions or billions—but in fact, it makes a huge difference, because it means you don't need to accept everything right away. You can think about it. You have other options, you can start a company, you can start projects which do not require you to pay your rent every month. This changes the distribution of power in society.

Now, there are other ways to change the distribution of power in society. This includes participation in the electoral process, the financing of political parties and the media in a much more egalitarian manner. There are proposals that have been made about democratic equality vouchers, so that we have a much more egalitarian distribution of power with respect to political influence. This also involves more democracy and your workplace. And I want to stress this because we didn't have time to talk about it, but I think one of the very successful transformations of the 20th century was more workers’ rights in particular. There are countries like Germany, Sweden, Nordic countries, where workers have up to 50% of voting rights in the board of corporations. And, okay, it's always 50% plus one for shareholders. But it means that if in addition to this 50% of voting rights as workers, workers also have a 10% stake in the capital of the company, or if a local government has a 10% stake in the capital of the company, then the majority can shift to workers, even in front of the shareholders who have 90% of the stock of the company. And I can tell you that from the point of view of a shareholder, in France, or in the US or UK, where you don't have these kinds of concentration, this looks like communism, except that this has been done in Germany and Sweden since the 1950s and has been very successful. I think this has allowed workers to be involved in the long-term strategy of companies. I think, in the societies that I imagine in 50, 60, 80 years, we should build on that and go even further.

What I propose in my book is that you should have at least 50% of voting rights for worker representatives in all companies, small and large. And though the other 50% of voting rights go to shareholders, you could have a cap on the maximum share of voting rights going to single shareholder—I mean, we're not going to decide today about the perfect formula. But you see, the general idea is that one single individual cannot have so much power. The fact that you had good ideas at the age of 25, or that you were very lucky, or both, should not imply that you keep all the decision-making power at the age of 50, 80, or 90—especially with the very long life expectancy that we have today. You need to rebalance and redistribute power permanently in society, through the tax system, and redistribution of wealth, but also through the legal system of how companies and economic units are being governed. This is a kind of circulation of power that I imagine in the future.

If someone today were to look at the workers’ or tenants’ rights in 1910, the property owner, because they own the building or the company, can fire workers or tenants, or can double the rent or divide their wage by two the next morning. When we look at that today, we say, “Okay, this was really very extreme, and today there are rules against this.” I'm looking at the transformation of these rules in the long run. But, of course, the real course followed by history is always different from what we can plan rationally. I'm just trying to give some hints about possible trajectories. With big crises, in particular the environmental crisis to come, we invent the solution. And I think that, together with the competition with China and autocracies, we can change attitudes to wealth inequality and attitudes towards the economic system very fast. Because when people see the concrete consequences on their life much more strongly than what they can see today, I think attitudes will change toward people who do space tourism and take their private jet all day long and want to give lessons to the rest of the planet about how to solve their problems. I think people will not find this very funny for very long.

So, there are many forces of transformations that are difficult to forecast. But I think, just like in the past, can transform power relations, and in the end, institutions, much faster than what we typically imagine. What the elites in every society always say, of course, is that nothing is ever going to change, and nothing can ever change. Except that things always change. And it will be the same in the future as it was in the past. The lessons from economic and political history can maybe contribute to the kind of democratization of economic knowledge that we need in order to prepare this possible change. But it will take a major social and political fight, obviously.

Please do listen and spread the word about The Good Fight.

If you have not yet signed up for our podcast, please do so now by following this link on your phone.

Email: podcast@persuasion.community

Website: https://www.persuasion.community/

Podcast production by John T. Williams and Brendan Ruberry. Podcast cover image by Joe O’Shea.

Connect with us!

Twitter: @Yascha_Mounk & @JoinPersuasion

YouTube: Yascha Mounk, Persuasion

LinkedIn: Persuasion Community

Share this post